What is considered complete insurance coverage insurance policy to one driver might not be the very same as even an additional motorist in the very same household (prices). Preferably, full coverage suggests you have insurance coverage in the kinds as well as amounts that are ideal for your earnings, possessions and also risk profile.

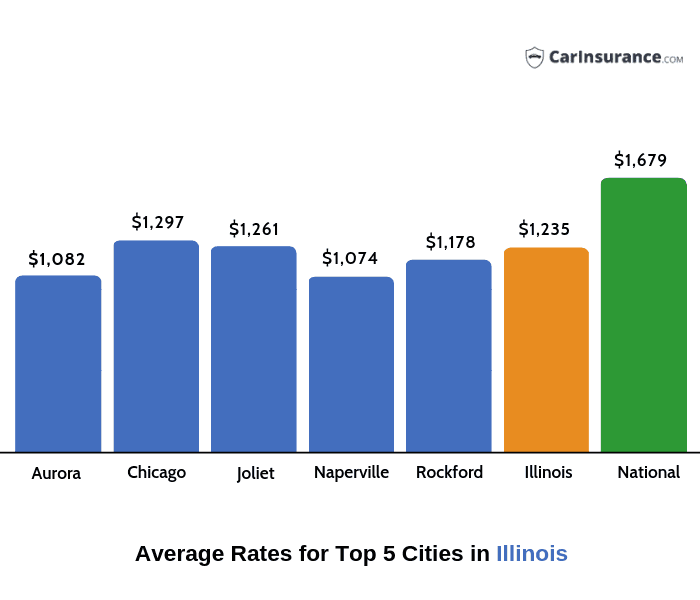

Rates likewise vary by hundreds and even countless bucks from company to business. That's why we constantly recommend, as your very first step to conserving cash, that you contrast quotes. Right here's a state-by-state comparison of the ordinary annual price of the following protection degrees: State-mandated minimum liability, or, bare-bones protection needed to legally drive a car, Complete insurance coverage obligation of $100,000 each injured in a crash you trigger, up to $300,000 per accident, as well as $100,000 for property damages you cause (100/300/100), with a $500 deductible for extensive and accident, You'll see just how much complete insurance coverage auto insurance expenses each month, and also yearly.

car cheapest car insurance insurance companies cheap car

car cheapest car insurance insurance companies cheap car

The typical yearly price for complete protection with greater obligation restrictions of 100/300/100 is around $1,150 even more than a bare minimum plan. If you pick lower responsibility limitations, such as 50/100/50, you can conserve but still have suitable security. The typical monthly price to increase protection from state minimum to complete coverage (with 100/300/100 limitations) is regarding $97, but in some states it's much less, in others you'll pay more (insure).

Your auto, up to its fair market worth, minus your deductible, if you are at mistake or the various other chauffeur does not have insurance or if it is ruined by an all-natural calamity or swiped (compensation as well as collision)Your injuries as well as of your passengers, if you are struck by an uninsured motorist, as much as the limits of your uninsured vehicle driver policy (without insurance vehicle driver or ).

Aflac - America's Most Recognized Supplemental Insurance ... - Questions

cheaper car insurance liability insured car perks

cheaper car insurance liability insured car perks

Full insurance coverage automobile insurance coverage policies have exemptions to particular events. Each full cover insurance coverage plan will certainly have a list of exclusions, meaning products it will not cover. Competing or various other rate contests, Off-road use, Usage in a car-sharing program, Catastrophes such as war or nuclear contamination, Damage or confiscation by government or civil authorities, Using your lorry for livery or distribution objectives; organization use, Intentional damage, Freezing, Deterioration, Mechanical breakdown (frequently an optional coverage)Tire damage, Items taken from the automobile (those may be covered by your home owners or tenants policy, if you have one)A rental cars and truck while your very own is being repaired (an optional insurance coverage)Electronics that aren't completely attached, Custom-made components as well as equipment (some percentage may be defined in the plan, but you can normally include a motorcyclist for higher amounts)Do I require full insurance coverage cars and truck insurance? You're required to have responsibility insurance policy or some various other evidence of economic responsibility in every state.

You, as a vehicle owner, are on the hook personally for any injury or residential or commercial property damages beyond the restrictions you selected. Your insurance business will not pay even more than your limit. But responsibility protection will not pay to repair or replace your vehicle. If you owe money on your vehicle, your lending institution will need that you purchase accident as well as extensive insurance coverage to secure its investment. credit.

Right here are some policies of thumb on insuring any auto: When the auto is brand-new and also financed, you have to have full coverage. cheap car insurance. (Higher deductibles help reduce your costs)When you reach a point economically where you can change your vehicle without the assistance of insurance, seriously take into consideration dropping extensive and collision. car.

It'll additionally recommend insurance deductible limits or if you need coverage for uninsured driver coverage, medpay/PIP, as well as umbrella insurance policy (cheapest car). The ideal method to find the most inexpensive complete protection auto insurance policy is to shop your insurance coverage with different insurance providers - liability.

The Basic Principles Of Full Coverage Car Insurance Cost Of 2022

Here are a few suggestions to adhere to when buying economical complete insurance coverage car insurance coverage: Ensure you correspond when shopping your liability limits. If you pick in physical injury liability per person, in physical injury obligation per mishap and also in home damages responsibility per crash, constantly go shopping the exact same insurance coverage degrees with various other insurance firms (insurance company).

credit dui cheap auto insurance perks

credit dui cheap auto insurance perks

These protections are part of a complete insurance coverage plan, so a costs quote will be essential for these protections. Both crash and extensive included a deductible, so make sure constantly to select the very same insurance deductible when purchasing protection. Selecting a greater deductible will certainly push your costs lower, while a reduced insurance deductible will cause a greater premium - trucks.

There are various other insurance coverages that assist make up a complete coverage bundle - cheap car insurance. These insurance coverages differ yet can consist of: Uninsured/underinsured vehicle driver coverage, Accident protection, Rental reimbursement insurance coverage, Towing, Void insurance coverage, If you require any of these additional insurance coverages, always pick the exact same coverage levels and deductibles (if they apply), so you are comparing apples to apples when purchasing a brand-new plan - cheapest.

Can I drop full coverage car insurance coverage? If you can handle such a loss-- that is, replace a stolen or completed cars and truck without a payment from insurance coverage-- do the mathematics on the potential cost savings and also think about going down insurance coverages that no longer make sense.

Some Known Incorrect Statements About Auto Insurance Revealed - How Many Us Drivers Don't ...

Going down comprehensive and collision, she would pay about a year a financial savings of a year. Allow's say her cars and truck is worth as the "real cash value" an insurance business would certainly pay. If her cars and truck were amounted to tomorrow and also she still lugged complete insurance coverage, she would obtain a look for the vehicle's real money worth minus her insurance deductible.

Of program, the auto's worth goes down with each passing year, and so do the insurance coverage costs. Complete insurance coverage cars and truck insurance coverage Frequently asked question's, How much is complete protection insurance policy on a brand-new auto?

low cost auto vehicle insurance car business insurance

low cost auto vehicle insurance car business insurance

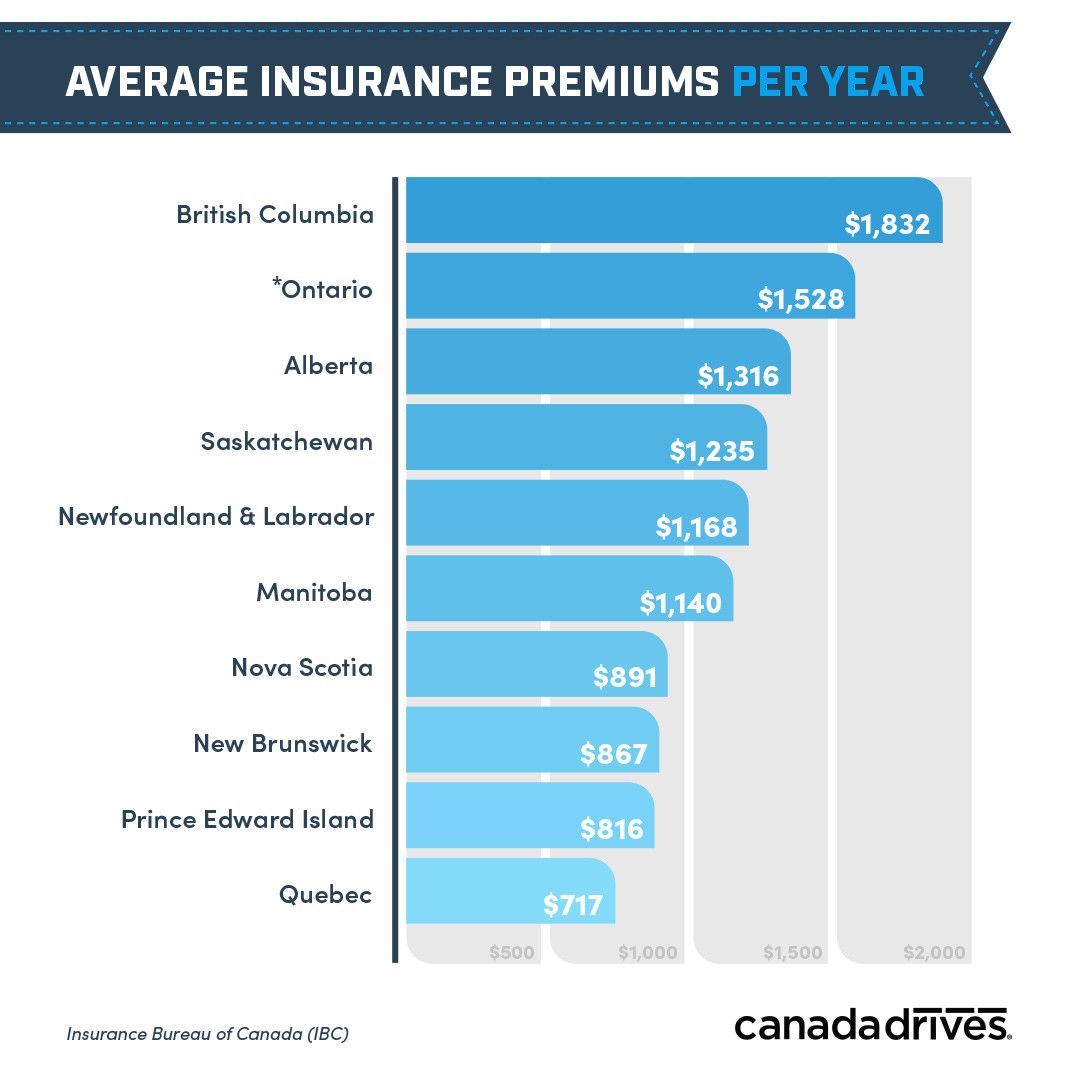

Louisiana's ordinary premium came in at in 2021, which is a shocking 99% more than the national average of. Maine has the cheapest full automobile insurance policy price on the other end of the range, with an average costs of a year. Just how much is complete insurance coverage insurance policy for 6 months? Complete coverage six-month prices will certainly differ throughout states as well as different other aspects but the national average for a six-month full protection policy is.

If you are financing your vehicle, your insurance company will likely call for that you lug minimum full protection for financed cars and truck to safeguard their investment in your automobile. Expect you aren't carrying detailed or crash coverage and also your lorry is damaged in a crash by a severe weather condition occasion or other risk.

Average Cost Of Car Insurance In 2021 - The Motley Fool Can Be Fun For Everyone

Till you own your automobile outright and can pay for to repair or change it, if needed, you need to be bring full coverage insurance policy. What is considered full coverage auto insurance policy? Technically, there is no such point as a "full insurance coverage" insurance plan. The term "full protection" simply describes a collection of insurance coverage coverages that offer a vast variety of securities, essentially, securing your car in "full (car insurance). "While "full protection" can imply different points to various people, a lot of vehicle drivers think about full Get more information protection vehicle insurance policy to consist of not only required state insurance coverages, such as responsibility insurance policy yet detailed as well as crash insurance coverages.

That has the least expensive full insurance coverage vehicle insurance policy? There is no real method to identify who has the least expensive complete insurance coverage automobile insurance coverage as insurance policy premiums can differ significantly even within the same community. Insurance firms take into consideration a variety of elements when setting a premium, and most of those elements are individual, so prices can vary substantially in between motorists.

Constantly make certain you are comparing apples to apples when it involves insurance coverage levels and deductibles. car.

Michigan's statewide average $2,535 annually still clocked in far greater than the national standard of $1,483 each year, as well as with an average of $5,072 per year, Detroit still published the highest ordinary car insurance policy prices in the U.S (accident).The typical annual rate for vehicle drivers in the Grand Rapids metro area was $2,349, The Zebra analysis found - insure.

The Of How Many Us Drivers Don't Understand Their Policies?

Prior to July 2020, all Michigan drivers had to have unlimited injury protection (PIP) coverage on their insurance. However on all policies issued or restored after that, vehicle drivers have had the choice to select a various level of insurance coverage or opt-out entirely if their medical insurance covers auto-related injuries.

Various other vehicle drivers can select to keep unrestricted PIP coverage or choose coverage plans topping out at $500,000, $250,000 or $50,000 for Medicaid recipients. One immediate conserving for motorists came from a decrease in the expense of the Michigan Catastrophic Claims Organization fee. If drivers don't choose endless PIP coverage, they do not have to pay a fee whatsoever.